Background

This is the second cut at writing the summary for this product after descending into a bit of a rant on the first effort! I’ve moved this into its own blog post so that this one remains more upbeat and positive!

I am the first to admit that tax reporting sucks. (sorry, this is actually the upbeat version). It is onerous and a burden to businesses.

I, and indeed most of my colleagues at Cortex have delivered a lot of tax reporting solutions. Our first batch kicked off in 2012 as businesses readied themselves for US and UK FATCA, and I dont think we have yet had a year when we haven’t done something CRS/FATCA-ry.

We have helped a lot of these companies over the years, big and small.

- We’ve helped the larger multi-national companies put in place bespoke systems that allow them to review and manage their client data and via a data warehouse mash it all together with feeds from the core systems to produce their FATCA and CRS submissions.

- We’ve helped lots of smaller and mid-sized companies (specialist fund managers, trust companies etc) produce simple extracts from their systems that can then be fed in to an oojamaflip that spits out compliant CRS and FATCA xml submissions.

Report Genie

Whilst we love writing the same thing over and over again (we really don’t), we created Report Genie, our oojamaflip to make this process as painless as possible for us and our clients.

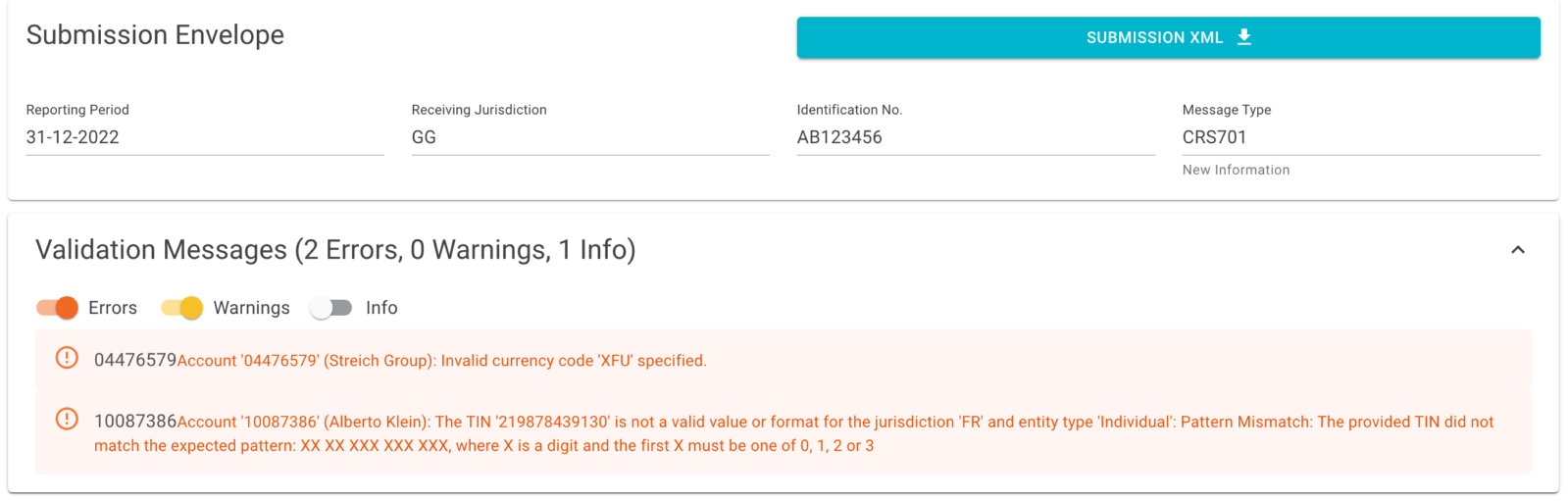

Report Genie is cool (for a tax reporting product). It does the things you would expect it to do, it validates the data and applies the rules, but the front end is super slick and snappy. You can review the submission easily and quickly filter down to any of the accounts with warnings or errors. We’ve got the majority of the country specific TIN rules implemented and are able to report any squiffy looking TINs.

Corrections

It is particularly good at handling corrections which can be a right PITA. Simply…

- Upload the original submission

- Download the information in excel

- Amend this as necessary

- Removing any rows that are fine

- Flagging the rows that should be Deleted from the previously submitted report

- Amend any of the data previously submitted

- Upload the updated excel document

- Review the changes and download the submission XML

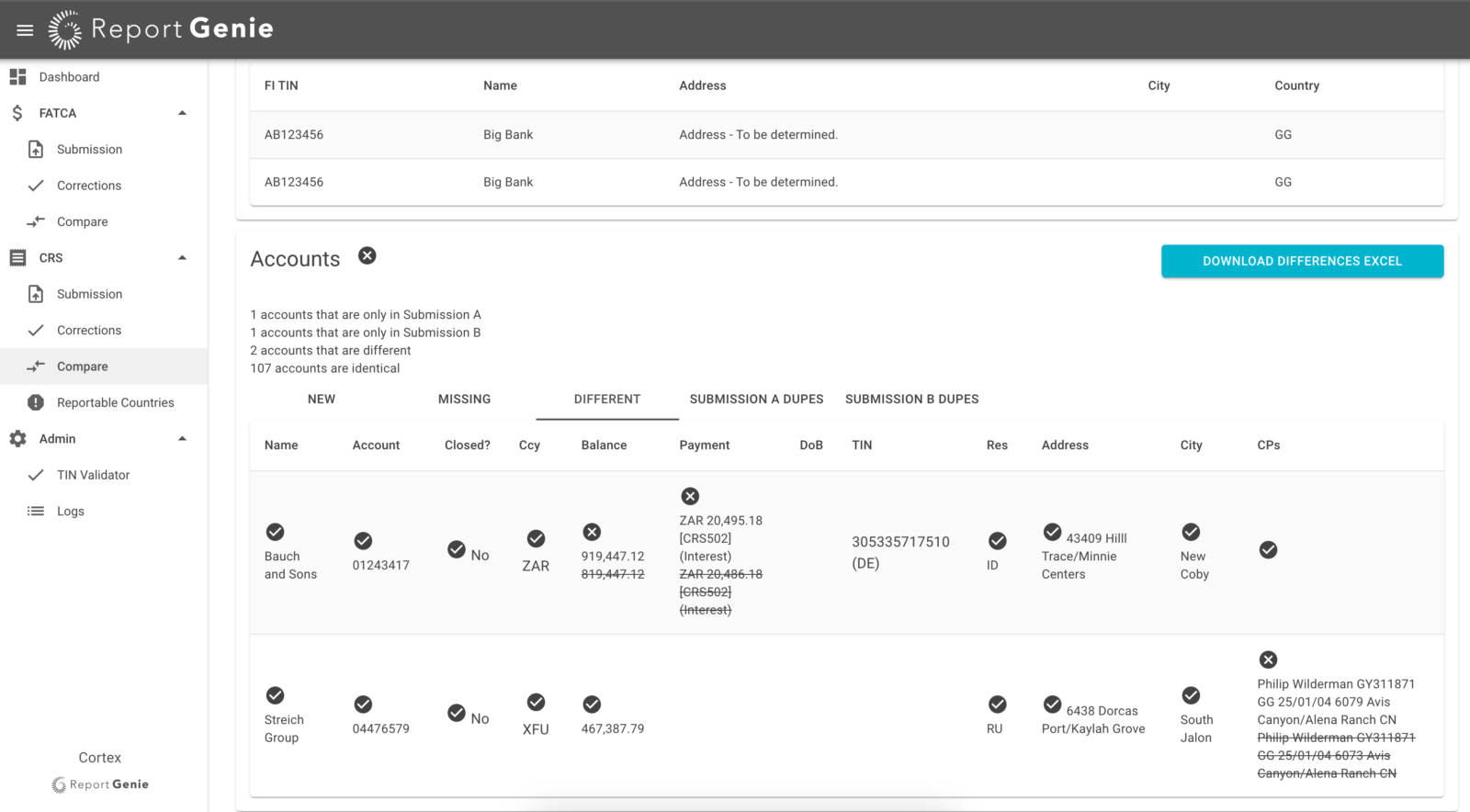

It also has a fancypants comparison page. If you are one of those businesses that have a directory full of XML documents…

- CRS_2022.xml

- CRS_2022 v1.0.xml

- CRS_2022 v1(final).xml

- CRS_2022 v3.xml

and you aren’t sure which one is which and want to know what is different between them then Report Genie will take two files and summarise the differences for you.